Setting up taxes and tax rates is one of the first jobs you will need to think about when setting up a store. You may need to consult with a tax professional or an accountant on what may be your best options, as well as considering any relevant laws in your state, country or business area.

Enabling Taxes

To access the tax settings screens, you will first need to enable them in general settings.

- Go to Classic Commerce > Settings > General.

- Select the Enable Taxes and Tax Calculations checkbox.

- Save changes.

Configuring Tax Options

To start configuring taxes go to: Classic Commerce > Settings > Tax. (NB: This tab will only be visible if taxes are enabled.)

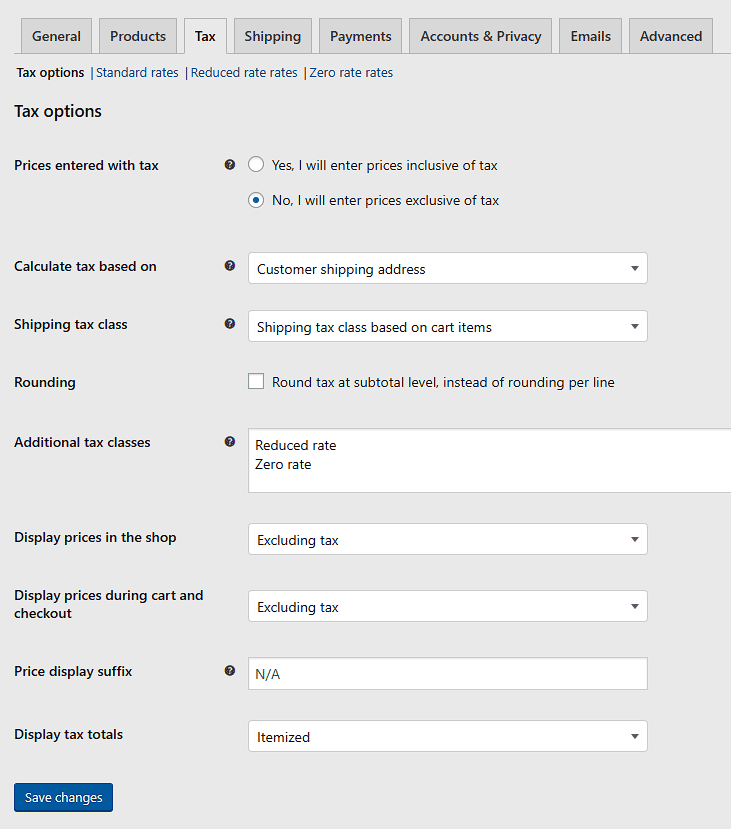

The Tax tab will displays various options that can be set to suit your needs. The settings you choose are based on the tax jurisdiction under which your store is located.

Prices Entered With Tax

This option is perhaps the most important when managing taxes in your store, as it determines how you input product prices later on.

“Yes, I will enter prices inclusive of tax” means that all catalog prices are input using your store’s base tax rate.

For example, in Australia the tax (GST) is 10%. You would input prices inclusive of the 10% tax rate e.g. a product price of $100.00 that includes $9.09 in tax. A customer in Australia would pay $100.00 as defined, but a customer in the UK would only pay $90.91.

“No, I will enter prices exclusive of tax” would mean that your catalog prices need to be tax exclusive.

Using the example from above, an Australian shop would enter $90.91 as the product price. A tax of 10% would be applied on top of this during checkout making the amount payable $100.00.

The tax calculation for tax-inclusive prices is:

tax_amount = price - ( price / ( ( tax_rate_% / 100 ) + 1 ) )

The tax calculation for tax-exclusive prices is:

tax_amount = price * ( tax_rate_% / 100 )

Calculate Tax Based On

This setting determines which address is used for tax calculations.

- Customer billing address

- Customer shipping address (default)

- Store base address

If you use store base address, taxes are always based on your store location and not your customer’s location.

Shipping Tax Class

In most setups, shipping tax class is inherited from the item being shipped, e.g., Shipping a reduced rate item such as baby clothes would also use a reduced rate. If this is not the case in your jurisdiction, choose a different tax class.

In the case of multiple tax rates in the order, the shipping tax will be applied as follows:

- If you have a product with the

Standardrate in the order, it will be used for the shipping regardless if this rate is high or low; - If you don’t have a product with the

Standardrate in the order, then the first rate found in theAdditional tax classsection will be used for shipping.

The goal is to make sure that your highest rate is listed as the first in the Additional tax class section if you don’t use the Standard class and if you need the highest tax rate to apply to shipping, for example.

Rounding

If you enable Rounding tax at subtotal level, instead of per line, the rounding is done at the Subtotal level. Check your tax jurisdiction to know if this should be done.

Additional Tax Classes

Tax Classes are assigned to your products. In most cases, you want to use the default Standard class. If you sell goods that require a different tax class (i.e., Tax, except zero-rated products) you can add the classes here. To get started, we include Standard, Reduced Rate and Zero Rate tax classes.

Each class is listed at the top of the tax settings page – click a class to view tax rates assigned to the class.

Display Prices in the Shop

This option determines how prices are displayed in your shop/catalog. Choose from inclusive/exclusive tax display.

Display Prices During Cart and Checkout

This option determines how prices are displayed in your cart and checkout pages – it works independently of your catalog prices. Choose from inclusive/exclusive tax display. Note: The address field needs to be filled in to get tax calculations if you have a tax table that distinguishes between locations.

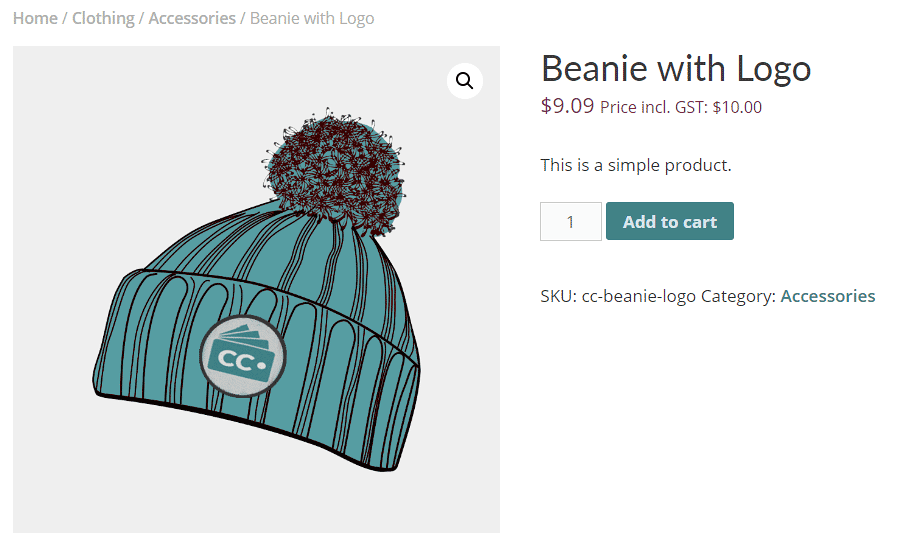

Price Display Suffix

Allows you to change display to: “Prices include __% tax” or anything appropriate for your store. You can use these two placeholders if you want to have text before and after the price:

{price_including_tax}

{price_excluding_tax}

For example: “Price incl. GST: {price_including_tax}” will display as: “Price incl. GSTT: $10”. So, if you’ve set the taxes to display excluding tax, you could add in small print what the tax inclusive of tax will look like.

Display Tax Totals

This determines if multiple taxes get displayed as one total during checkout, or as an itemized list of taxes.

Setting up tax rates

Tax classes are displayed at the top of the tax screen. Click one to view tax rates for the class.

In the tax rates table, you can define tax rates (one per row). Click Insert Row to get started.

Each tax rate has these attributes:

- Country Code – 2 digit country code for the rate. Use ISO 3166-1 alpha-2 codes. Leave blank (*) to apply to all countries.

- State Code – 2 digit state code for the rate. See

i18n/states/COUNTRYCODE.phpfor supported states. For the US, use a 2 digit abbreviation e.g. AL. Leave blank (*) to apply to all states. - ZIP/Postcode – Enter postcodes for the rate. You may separate multiple values with a semi-colon (;), use wildcards to match several postcodes (e.g. PE* would match all postcodes starting with PE), and use numeric ranges (e.g. 2000…3000). Leave blank (*) to apply to all postcodes.

- City – Semi-colon separated list of cities for the rate. Leave blank (*) to apply to all cities.

- Rate % – Enter the tax rate, for example, 20.000 for a tax rate of 20%.

- Tax Name – Name your tax, e.g. VAT

- Priority – Choose a priority for this tax rate. Only 1 matching rate per priority will be used. To define multiple tax rates for a single area you need to specify a different priority per rate.

- Compound – If this rate is compound (applied on top of all prior taxes) check this box.

- Shipping – If this rate also applies to shipping, check this box.

Importing and exporting rates

There are Import CSV and Export CSV buttons below the table with the rates. You can use them to import and export tax rates to and from a CSV file.

The CSV file for importing requires 10 columns;

country code, state code, postcodes, cities, rate, tax name, priority, compound, shipping, tax class

Leave tax class blank for standard rates.

There is a sample tax rate csv file available for import. For more details see this page: Importing Sample Data

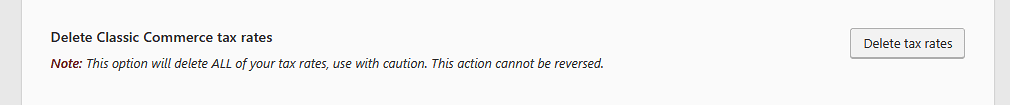

Deleting tax rates

If you incorrectly added tax rates or the CSV import has incorrectly added tax lines, this information needs to be deleted.

To delete:

- Go to: Classic Commerce > Settings > Tax > Your Tax Rates (Standard, Reduced Rate, Zero Rate)

- Select the incorrect lines by clicking on them. They are highlighted in yellow.

- Select Remove Selected Rows. This deletes the highlighted row(s).

- Save changes.

If you want to delete all tax rates at once, use Delete Classic Commerce Tax Rates in Classic Commerce > Status > Tools.

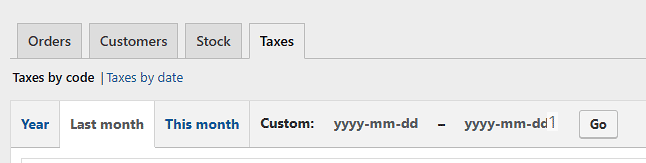

Viewing tax reports

Tax reporting can be found in Classic Commerce > Reports > Taxes > Taxes by date. These reports allows you view taxes for the year, last month, this month or a custom date range.

Going to Reports > Taxes > Taxes by code displays a different report, showing taxes separately.

Frequently Asked Questions

Why do prices change when “Prices Include Tax”?

If you are entering prices including tax, you should be aware that this price might change based on the country in which your customer is located.

For example, your store is in the UK, so you create one tax rate for GB of 20%.

- You create a product with a tax inclusive price of £120.

- Customers in the UK will pay £120 (£100 + £20 VAT).

- Customers outside the UK will pay £100 because you do not have any tax rates set up for any other country.

OR

Your store is in the UK, so you create one tax rate for GB of 20%, a tax rate for France of 19% and Norway at 25%.

- You create a product with a tax inclusive price of £120.

- Customers in the UK will pay £120 (£100 + £20 VAT).

- Customers in France will pay £119 (£100 + £19 Tax).

- Customers in Norway will pay £125 (£100 + £25 Tax).

- Customers outside the UK, France or Norway will only pay £100 because you do not have any tax rates set up for any other countries.

When some users visit my store, taxes are not shown.

Since taxes are based on customer location in most setups, things like geolocation can make taxes hidden until the user checks out and inputs their real address.

To prevent this, go to Classic Commerce > Settings > General > Default Customer Location to disable Geolocate and set to the Shop Base Address.